Develop a long-term NFT vision that really works

Big companies are investing in NFTs and we will help you broaden your knowledge regarding this universe, to create a better NFT vision and understand more about it, what works, and if is worth investing.

Many experts have commented on the market advantages and disadvantages of these non-fungible tokens. For some this is just a fad and even a hoax.

However, big names in the market have joined this business model.

Companies like Disney recognize the potential of the digital world and blockchain technology.

The famous coffee chain Starbucks, for example, is also preparing to launch its own NFTs. The company plans to expand the “community” vision by adding this digital asset into something like an access pass to unique experiences.

Another supporter of the idea is GAP, which recently announced the launch of NFTs for its much-loved and desired hoodies. Ferrari has also signed a contract with a leader in blockchain technology and NFTs, Velas Network. The focus of this action is on the creation of digital content focused on the brand’s fans.

But to better understand the signs that point to the growth of this market in such a robust way, we prepared this article.

In the next few lines, we will help you to better understand and expand your view, and help you to develop a long-term NFT vision, explain how they work and, of course, if they are worth investing in.

What are NFTs?

First we need to understand what a non-fungible token means and the difference between it and the fungible token.

Fungible, by definition, means something that can be replaced by something else of the same kind, quality, quantity and value. That is, a (money) note, for example, is a fungible asset. If you have one $20 bill or two $10 bills, you will have the same final value, correct?

On the other hand, if you have a property worth 1 million dollars and if you have two properties worth 500 thousand dollars each, they are not the same thing, they do not necessarily have the same value over time, since each one has its particularities and is many different. They are therefore non-fungible assets.

There are two types of categories for fungible and non-fungible assets, which are physical assets and digital assets.

Check out some examples:

- Physical: which can be fungible such as the dollar, gold or casino chips and non-fungible such as works of art, movie tickets, real estate, among others.

- Digital: These are fungible digital assets such as bitcoin, ethereum or airline miles, for example. On the other hand, non-fungible digital assets can be video game skins (the look or clothing), digital works and others.

With this digital universe totally wide open today, an image on the internet can be copied and used by anyone. So what drives a person to pay millions for the purchase of an NFT?

While you can copy an image from the internet – although you shouldn’t – it won’t be yours unless you record it on a blockchain, which works like a ledger that records all virtual currency transactions.

The Token is what tells the market that that image has an owner, registered on the blockchain for eternity.

How do NFTs work?

NFTs are offered for sale in a specific marketplace and when acquired, they become, in a way, the exclusive property of the investor.

And that’s where the market interest and your NFT vision comes in. Because it is unique and registered, it generates a feeling of scarcity, speculation and interest responsible for the phenomena in sales.

The Twitter CEO, for example, sold his first tweet for $2.9 million as an NFT.

And of course you can also enter this universe and earn money, check out some apps to earn money by creating your NFTs

How is the NFT market?

According to a report by DappRadar, a data tracking website for blockchain-based applications, the NFTs market moved around US$25 billion in 2021. A significant growth compared to the previous year, which moved only US$94.9 million.

And a lot will still happen, according to a specialist in the field, the market will explode because of the metaverse – where items from the environment are traded as NFTs.

How to acquire NFTs and NFT Vision?

You will need to follow a few steps, such as signing up to the platforms that sell the assets, to later find and evaluate the best moment and the best choice.

But, did you know that tokens are only traded with cryptocurrencies? For this, it is also necessary, before making the purchase, to check if there are enough cryptocurrencies funds or to acquire them.

And to do this, you will have to look for a financial institution that trades the assets, such as Binance, Coinbase Exchange, FTX, Kraken, etc.

After paying for the cryptocurrencies, and having your assets transferred by the financial institution to your digital wallet, you will only need to transfer the assets to the marketplace that is trading the NFT of interest to you.

However, be aware of the gas charge value, a fee that must be paid in the transaction, before the transfer.

Where to buy NFTs?

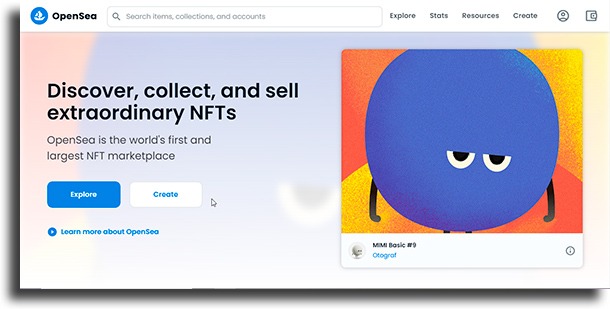

There are several stores, known as marketplaces, that sell NFTs. For example:

- Binance NFT;

- Solanart;

- Coinbase NFT;

- FTX NFTs;

- OpenSea.

Advantages and Disadvantages of Having NFTs

While this new universe is full of opportunities, there are still many scams and many dishonest people.

Investing and having a NFT vision is to seek knowledge in this new market to bring the necessary baggage in the not too distant future. Soon, when virtual reality technologies are more accessible, tokens will be part of brands’ routines.

Thus, those who have knowledge of the market will certainly come out ahead and have the long-awaited high profitability.

However, it is worth considering that, currently, these assets are at great risk of devaluation and still have low liquidity. In other words, it is not easy to sell or dispose of these assets.

Which leads us to the question: how much profit can you make from your projects and resales?

So here’s an important tip, maybe this market isn’t for everyone and understanding the business, in addition to understanding its goals, can be a determining point.

Ready to develop a long-term NFT vision that actually works?

Share with that friend who loves teaching cryptocurrency classes but has never invested in NFTs.

Or, who knows, forward the article to that artist or designer friend who may well develop an NFT vision and earn a lot of money, who knows, maybe a commission will come in for you there, huh?

And also read: